Share This Story

The Dutch pension system, the largest in the European Union, is undergoing a major transformation under the Wet Toekomst Pensioenen (WTP), effective July 1, 2023. This reform shifts the system from a defined-benefit model, which guarantees fixed payouts, to a collective defined-contribution model, where payouts depend on contributions and investment performance.

The change addresses challenges such as an aging population, financial sustainability, economic and market pressures, fairness across generations and evolving labor markets. In the defined-benefit model, pension funds relied heavily on long-term government bonds and interest rate swaps to hedge long-term liabilities. The new defined-contribution model removes this need for precise liability matching, prompting funds to reduce holdings in long-term bonds and shift toward higher-yielding assets such as equities, corporate bonds, and Dutch mortgages.

Why It Affects German, French, and Dutch Government Bonds

The Netherlands manages one of the largest pension fund asset pools in the EU-27, with €1.91 trillion in assets under management (AUM) as of 2024. This includes approximately €450 billion invested in European government bonds, with substantial holdings in German, French, and Dutch sovereign debt, driven by their high credit ratings (AAA/AA) and their critical role in liability-driven investment (LDI) portfolios.

The transition to a defined-contribution model reduces the need for long-term bonds, as funds no longer require extensive hedging for long-dated liabilities. According to Rabobank, the transition is projected to prompt a sell-off of around €125 billion in government bonds, with approximately €69 billion focused on German, French, and Dutch sovereign debt.

Key Drivers of Rising Bond Yields The Dutch pension reform in early 2026–2027 aligns with peak bond issuance, which may strain liquidity and heighten market volatility. Reduced demand from investors—such as Asian funds trimming Eurozone bonds—and the ECB’s quantitative tightening add further pressure to bond markets.

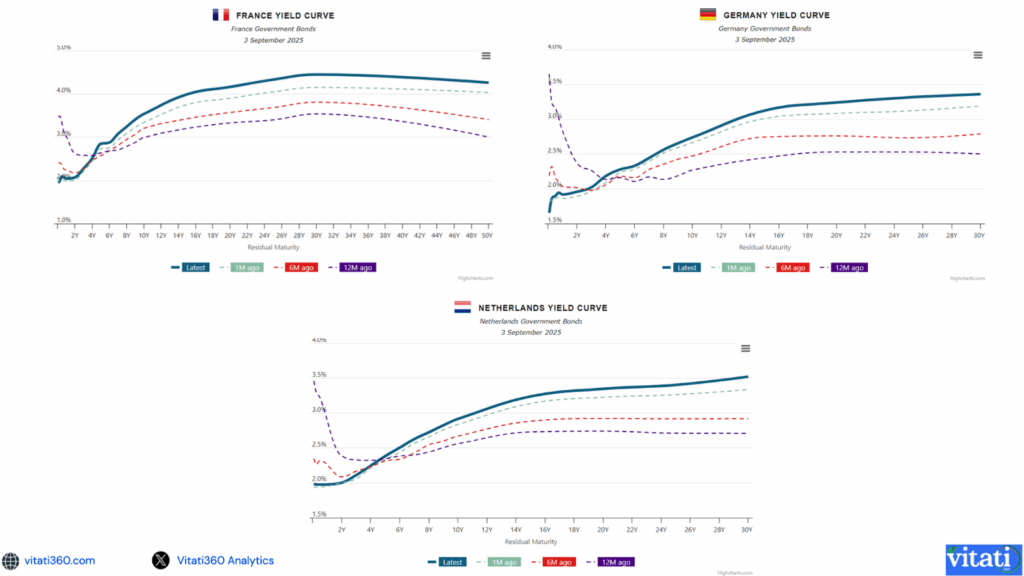

The Dutch pension reform steepens the yield curve, particularly beyond 30 years, as demand for ultra-long-dated bonds (30+ years) weakens, while hedging for shorter maturities (up to 20 years) remains strong. Historically, Dutch pension funds relied on these long-term bonds and interest rate swaps to hedge liabilities in the defined benefit system. The transition to a defined contribution model reduces this need, driving the unwinding of hedges and increasing liquidity pressure in the less liquid ultra-long segment (beyond 30 years).

Increased allocations to 10- to 20-year maturities maintain demand, potentially cushioning shorter-dated bonds. A one-year grace period enables gradual hedge adjustments, which could ease market congestion if timed well.

To summarise, recent Dutch pension reforms are expected to substantially decrease demand for long-dated government bonds issued by Germany, France, and the Netherlands—particularly those with maturities exceeding 30 years—due to reduced requirements for long-term hedging under the new defined contribution system. This development may lead to elevated yields, a steeper yield curve, and increased market volatility, most notably from early 2026. The strategic shift of funds toward shorter-duration securities and alternative investments underscores significant broader implications for European bond markets.